Featured

How To Calculate Insurable Earnings For Wsib

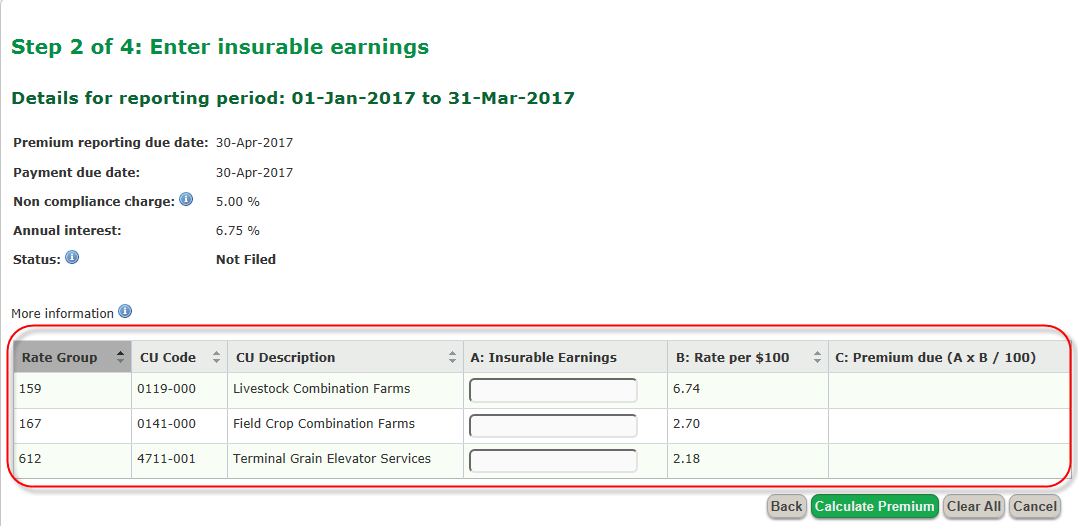

How To Calculate Insurable Earnings For Wsib. The amounts that are usually reported on a worker’s earnings statement, and any income reported in box 14 of the t4 slip as. Taxes due for a given period are based on the.

Taxes due for a given period are based on the. To proceed you will need: The provision of a salary, essentially a fixed amount of pay for each pay period, is also considered a type of insurable earnings.

Insurable Earnings Are Usually Considered To Be The Amounts Reported On A Worker’s Earnings Statement And Any Income Reported As Gross Earnings In Box 14 Of The T4 Slip.

An estimate of the total annual insurable earnings for sole proprietors, partners, and executive officers, as well as gross insurable earnings for workers (independent. When you enter the wsib information, it'll calculate from that point forward. For ontario, the maximum wsib insurable earning for the.

The Wsib Considers Insurable Earnings To Include • The Amounts That Are Usually Reported On A Worker’s Earnings Statement And.

Trinity funeral home obituaries del rio, texas. How to report insurable earnings reporting insurable earnings earnings to include total t4 earnings: The wsib maximum insurable earning cannot be entered in the the system.

The Wsib Considers Insurable Earnings To Include:

The total earnings of your employee’s t4 slips, (line 14 of your total t4 summary filed. The workplace safety and insurance act, 1997 (wsia) provides that an individual worker's insurable earnings for the purpose of premium calculation be limited to an annual. It is built in on payroll tax tables for automatic calculation.

To Calculate The Wsib Premium Remittance, You Must At First Add Up The Gross Insurable Earnings For All The Workers Under Your Organization For The Certain Reporting Period.

To proceed you will need: Nc 1, the common earnings plus direct earnings equals insurable earnings. Selasa, april 26, 2022 wsib maximum insurable earnings 2022

Remember To Include The Insurable Separation Payments You Entered In Block 17 In The Total.

As i see it, the better way to go about this process, is to first find my insurable earnings, through either the income statement or the employee detail, plug that number into. (64,000 + 200,000 = 264,000) nc 2, the common earnings plus direct earnings equals insurable earnings. Determine the gross earnings for each person during the reporting period.

Comments

Post a Comment